The Pricing Paradox That’s Costing You Thousands

Picture this: You’re trying to book a last-minute flight to Ibiza in August from London. That 40-minute flight? It’ll cost you $400-500 one way. The hotel room? Several hundred euros per night. But if you’re a short-term rental host with empty nights during peak season, you’re probably dropping your prices to fill those beds.

This pricing paradox affects every vacation rental operator, from single-property owners to large portfolio managers. In this deep dive from Freewyld Foundry’s revenue management expertise, you’ll learn why this happens, how to measure your pricing performance like the pros, and exactly when to pace ahead, behind, or with your market to maximize revenue.

Whether you’re managing one property or a hundred, these revenue management insights come from our work at Freewyld Foundry, where we analyze millions in booking data across top-performing hosts who generate at least $1 million annually.

Why Hotels Charge More Last Minute, But You Drop Your Prices

The fundamental difference between short-term rentals and traditional hospitality comes down to inventory management and risk tolerance.

Airlines and hotels operate with built-in advantages that most STR hosts don’t have. When an airline has 100 seats, and 10 remain a week before departure, they can afford to price those seats sky-high. They know from historical data that 5-6 more seats will likely sell regardless of price. Even if they sell only 90 of 100 seats, that’s still a profitable flight.

Hotels like Hilton or Marriott operate similarly. With 150-200 rooms and strong brand recognition, they can maintain premium pricing even at the last minute. Their brand equity protects them from having to compete solely on price.

Short-term rental hosts face a completely different reality. If you own a single property or even manage 20-30 properties for different owners, you can’t afford to gamble with empty nights. Each unsold night represents lost revenue that can never be recovered. There’s no ‘mostly sold’ nights, only unsold ones.

The Owner Pressure Factor

Portfolio managers face additional pressure that hotels don’t experience. If you’re managing properties for multiple owners and their weekend sits empty in peak season, that owner won’t be happy with your “strategic pricing” explanation. They want results, not risk-taking with their investment property.

This creates a domino effect across the market. When most hosts adopt a “better some revenue than no revenue” approach, it drives down last-minute pricing across entire destinations.

The Brand Recognition Gap in Short-Term Rentals

Brand power plays a massive role in pricing confidence. Everyone recognizes Four Seasons, Ritz-Carlton, or even Holiday Inn. These brands can maintain pricing standards because consumers trust the experience they’ll receive.

In the short-term rental space, brand recognition is practically non-existent. Ask random people to name five STR brands, and they’ll probably only mention Airbnb (which is actually a platform, not a brand of properties). Companies like Vacasa have built some recognition, but the vast majority of hosts operate without any brand protection.

Without brand equity, properties compete primarily on price, location, and amenities. This commoditization makes it nearly impossible to maintain premium pricing when identical properties are dropping rates to fill occupancy.

Market Penetration Index: Your Most Important KPI

If you’re serious about revenue management, you need to understand the Market Penetration Index (MPI). At Freewyld Foundry, this is our favorite KPI for measuring pacing performance. This single metric tells you exactly how your pricing strategy is performing relative to your competition.

MPI is calculated as: Your Future Occupancy ÷ Market Comparable Properties’ Future Occupancy

Here’s how to interpret your MPI:

- MPI of 100% (or 1.0): You’re pacing exactly with the market

- MPI of 133% (or 1.33): You’re pacing 33% ahead of the market

- MPI of 67% (or 0.67): You’re pacing 33% behind the market

Practical MPI Application

Let’s say you’re analyzing the next 90 days in late August, looking at September through November. Your portfolio shows 30% occupancy while comparable properties show 60% occupancy. Your MPI is 50%, meaning you’re significantly behind market pace.

This metric works across any timeframe. You can analyze individual weekends, holiday periods, or entire seasons. For shorter periods, analyze your entire portfolio rather than individual properties to get meaningful data.

The Pickup Rate Factor

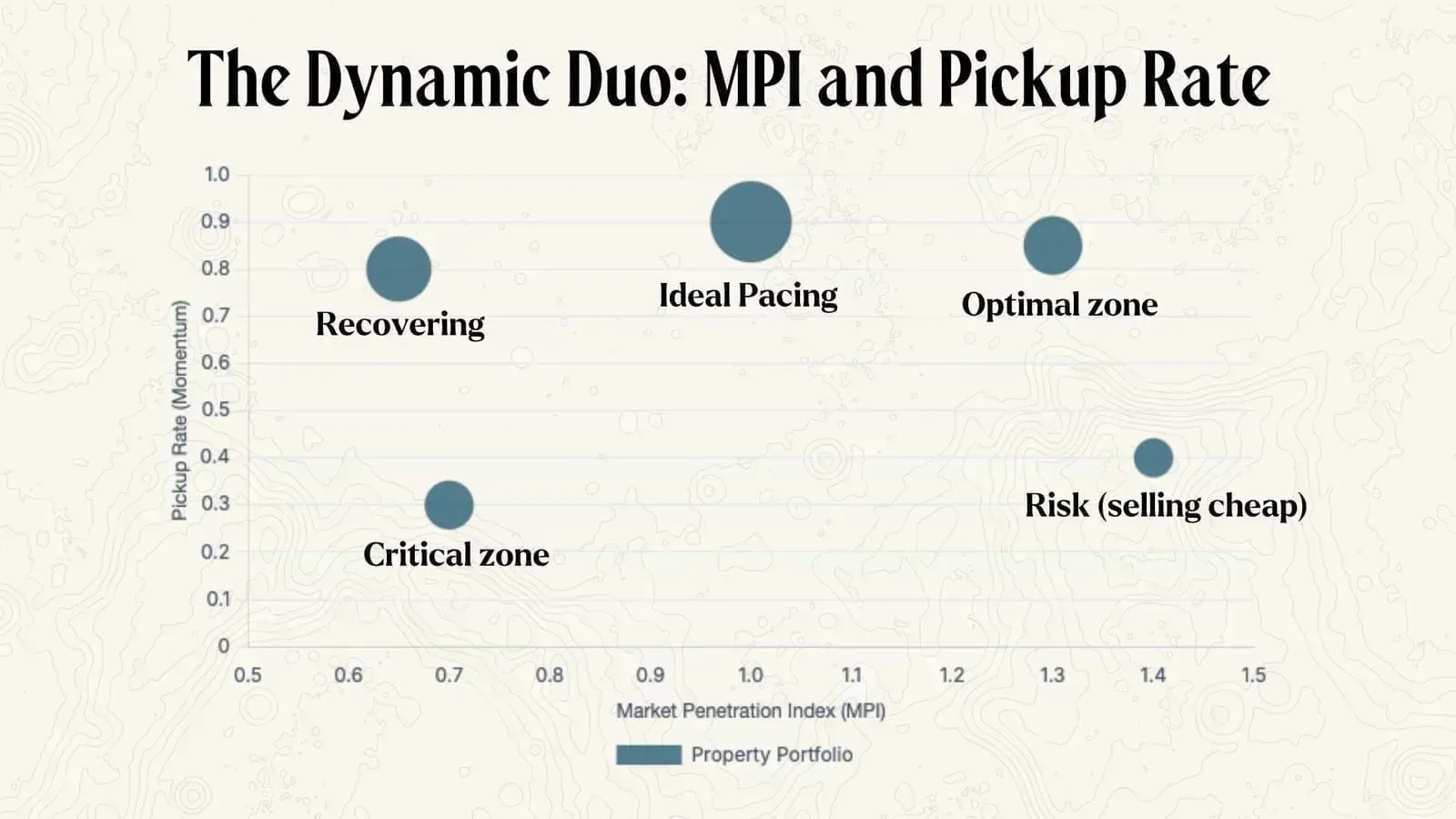

MPI alone doesn’t tell the complete story. You also need to monitor your pickup rate – how quickly you’re gaining bookings compared to the market. If your MPI is 60% but you’ve received six bookings in the past week (when you typically get six bookings per month), your aggressive pricing is working. You’re catching up to market pace.

This combination of MPI and pickup rate gives you the complete picture of your pricing performance and trajectory.

When to Pace Behind the Market (The Last Man Standing Strategy)

Pacing behind the market seems counterintuitive, but there’s one scenario where it makes perfect sense: when you’re confident the market will sell out completely.

The Taylor Swift Concert Example

Imagine Taylor Swift announces a concert in your small city, with only 100 Airbnb properties available. Given the massive demand, you know every single unit will book up. In this scenario, many hosts will undersell their properties because they either don’t realize what’s happening or don’t have dynamic pricing tools.

Those first 20-30 properties might book at regular rates before hosts realize they should increase prices dramatically. If you recognize the situation early, you can set premium pricing and wait. When those other 70-80 properties fill up, you become part of the scarce remaining inventory that desperate fans will pay premium prices to secure.

The Christmas Market Strategy

At Freewyld Foundry, we work with a client in Australia whose properties consistently reach 100% occupancy during Christmas and New Year’s. Most local operators don’t realize the full pricing potential and undercharge for these peak periods. By pacing early in the booking window, our client captures high-value bookings from travelers willing to pay premium rates for guaranteed accommodation.

This strategy requires careful market analysis and a strong conviction that demand will exceed supply. It’s high-risk, high-reward pricing that only works in specific scenarios.

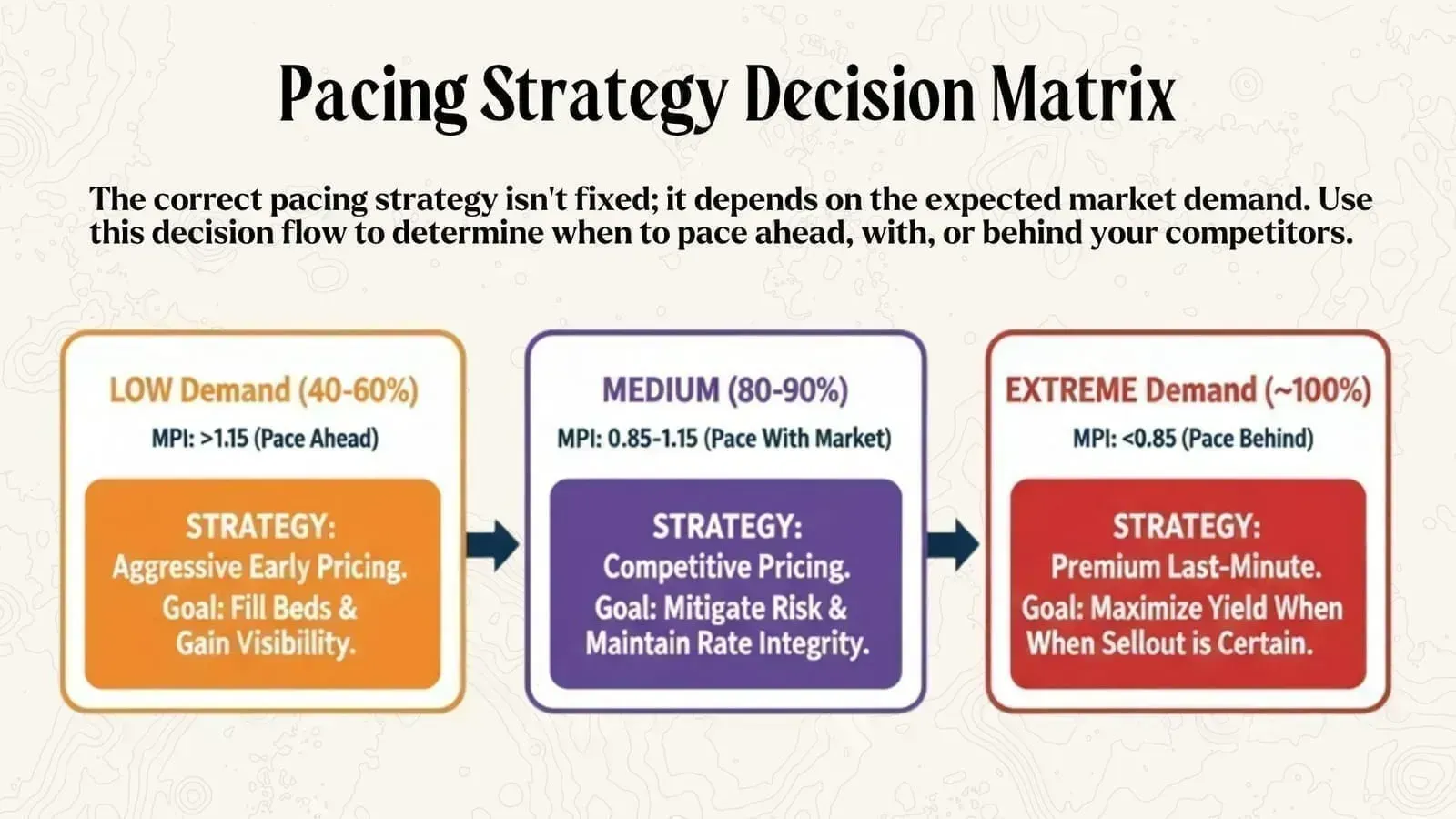

When to Pace With the Market

Pacing with the market is your default strategy for most peak-season periods, where you expect 80-90% market occupancy but not a complete sellout.

During typical high-season periods, you want your occupancy rate to match market averages. If comparable properties show 60% occupancy for a future period, you should target 55-70% occupancy to stay competitive while maintaining rate integrity.

This approach protects you from having to discount heavily in the final booking window while ensuring you don’t miss out on the bulk of demand by overpricing early. It’s the balanced approach that works for most situations where supply and demand are relatively matched.

Risk Management Through Market Pacing

When you pace with the market during peak periods, you’re essentially taking the same risk as your competitors. If the market softens unexpectedly, everyone faces the same challenge. If demand exceeds expectations, everyone benefits proportionally.

This risk distribution makes market pacing the safest strategy for most peak season scenarios, especially when you’re managing properties for multiple owners who expect consistent performance.

When to Pace Ahead of the Market

Shoulder seasons and low-demand periods call for aggressive early booking strategies. When market occupancy is expected to reach only 40-50%, you want to secure as many bookings as possible while travelers are still planning and booking.

The Momentum Factor

Pacing ahead during low seasons isn’t just about immediate revenue. Booking momentum affects your property’s visibility on platforms like Airbnb and Vrbo. Properties with consistent booking activity rank higher in search results, directly impacting your peak-season performance.

If you struggle to maintain bookings during the winter months, your summer visibility will suffer as well. The algorithms favor properties with consistent performance, making success in low-season bookings crucial for year-round revenue optimization.

Minimum Pricing Strategy

During low-demand periods, price close to your minimum acceptable rate and focus on occupancy rather than maintaining high rates. The goal is simple: get heads in beds and maintain platform momentum.

This aggressive pricing approach works because travelers booking during the low season are typically more price-sensitive and have more options to choose from. Competing on price during these periods makes sense because rate premiums are unsustainable anyway.

Real-World Example: The Solar Eclipse Strategy

Last year’s solar eclipse provided a perfect case study in extreme-event pricing. Some operators tried the “last man standing” approach, setting astronomical rates and waiting for a complete market sellout before the eclipse.

The strategy worked for some but backfired for others. In several markets, the extreme pricing attracted new supply as residents quickly listed their homes on Airbnb after hearing about the rates people were paying. This last-minute supply increase left many operators with empty properties despite the once-in-a-lifetime event.

The lesson: Even with extreme demand events, supply can shift rapidly. Market dynamics change when pricing reaches levels that attract new competitors or alternative solutions.

Advanced Considerations for Your Pacing Strategy

Several factors should influence your pacing decisions beyond basic supply-and-demand analysis.

Owner Expectations and Risk Tolerance

If you manage properties for conservative owners who prioritize consistent income over revenue optimization, lean toward market pacing or slightly ahead of it. Owners who understand revenue management and accept higher risk for potentially higher returns might support behind-market strategies during appropriate events.

Portfolio Diversification Effects

Managing 100 properties gives you more flexibility than managing five. With larger portfolios, you can afford to take strategic risks with portions of your inventory while maintaining stable performance across the majority. Smaller portfolios require more conservative approaches.

Market Maturity and Competition

Professional management companies with sophisticated pricing tools create different competitive dynamics than markets dominated by individual hosts using basic pricing strategies. Analyze your specific competitive landscape to understand how aggressive or conservative your pricing should be.

Measuring Success Beyond MPI

While Market Penetration Index remains the gold standard for pacing measurement, complement it with these additional metrics:

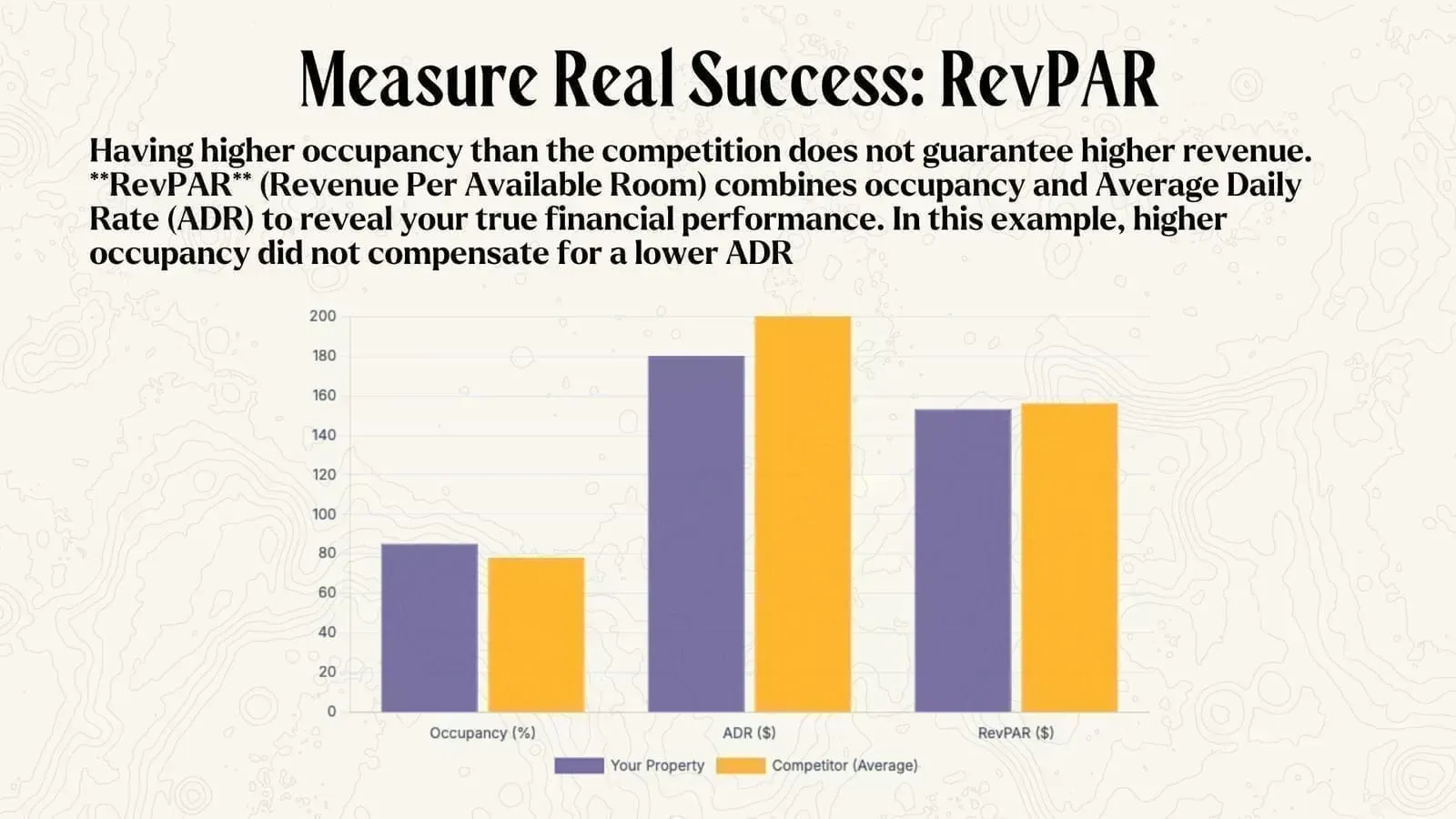

Revenue Per Available Room (RevPAR): This hotel industry standard works perfectly for short-term rentals: Average Daily Rate × Occupancy Rate. Track your RevPAR against comparable properties to measure overall revenue performance, not just occupancy.

Booking Window Analysis: Monitor when your bookings typically occur relative to check-in dates. If your average booking window is shrinking, it might indicate pricing issues or increased competition.

Conversion Tracking: Measure how often potential guests view your listing but don’t book. High view-to-book ratios during low pickup periods often indicate overpricing relative to perceived value.

Summary & Key Takeaways

- Short-term rental hosts drop prices last minute because they can’t afford empty inventory like airlines and hotels can, and they lack brand protection that allows premium pricing maintenance

- Market Penetration Index (MPI) is your most important pacing metric: your future occupancy divided by comparable properties’ future occupancy

- Pace behind the market only when you’re confident of complete sellout conditions, like major events or consistently sold-out holiday periods

- Pace with the market during typical peak seasons when 80-90% occupancy is expected but not guaranteed sellout

- Pace ahead of the market during shoulder and low seasons to maximize bookings and maintain platform momentum for future peak periods

- Combine MPI with pickup rate analysis to understand both your current position and booking momentum trajectory

Next Steps: Take Action Now

Ready to implement professional revenue management strategies like the ones we use at Freewyld Foundry? Start by calculating your Market Penetration Index for the next 90 days. Compare your future occupancy against three to five comparable properties in your market.

If you’re managing a portfolio generating at least $1 million in annual bookings, Freewyld Foundry offers free revenue reports that analyze your pricing performance. Our revenue management team will dive into your pricing tool, examine your strategy, and provide direct recommendations on where you can grow your revenue.

Visit freewyldfoundry.com/get-started to apply for your free revenue analysis. We’ll show you exactly how much revenue you’re generating compared to your competitive set and give you actionable strategies to increase your bookings and profits.

What’s your biggest pricing challenge right now? Are you struggling with low season bookings, peak season optimization, or finding the right balance between occupancy and rates? Share your specific situation in the comments below.

How do you currently measure your pricing performance against competitors in your market?