The Revenue Management Gap Most Hosts Don’t Know They Have

If you’re managing short-term rentals and not spending at least 15-30 minutes daily on revenue management, you’re leaving serious money on the table.

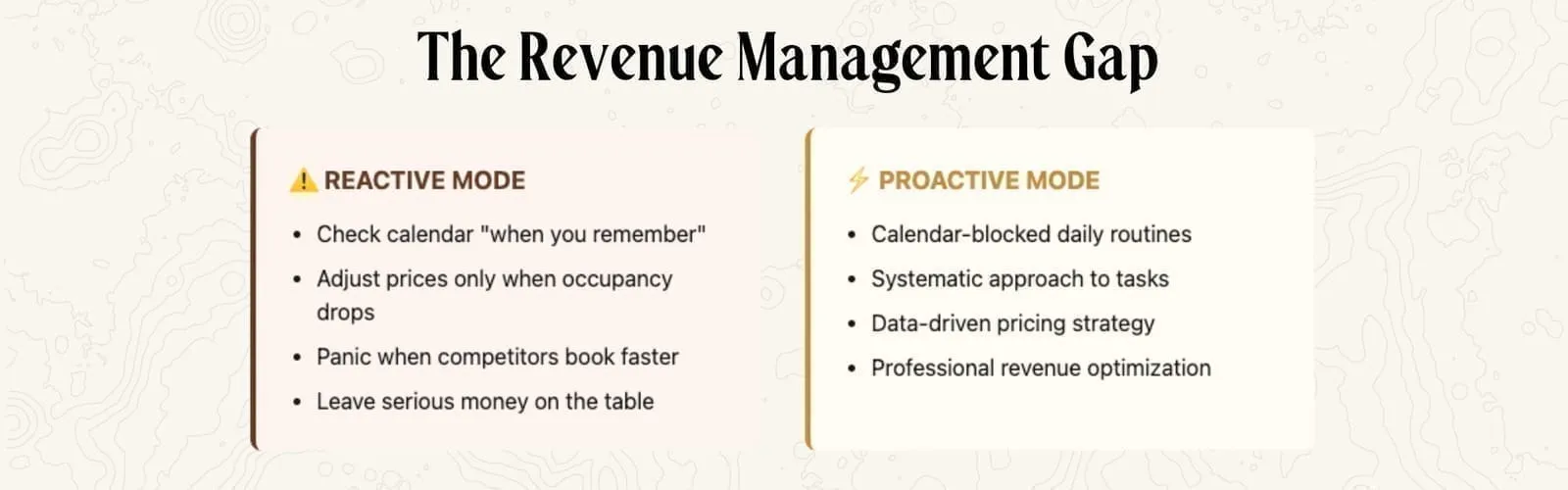

Here’s the uncomfortable truth: most hosts operate in reactive mode. They check their calendar when they remember. They adjust prices when occupancy drops. They panic when competitors book faster.

But revenue management isn’t supposed to work that way.

Through Freewyld Foundry’s revenue management service, we’ve analyzed hundreds of portfolios and consistently found the same pattern. Hosts understand revenue management is important, but they lack a clear process. They don’t have time blocked in their calendar. They don’t have a systematic approach to daily and weekly tasks.

This article changes that. You’re about to learn the exact daily and weekly revenue management cadences that professionals use to consistently outperform their markets. These aren’t theoretical frameworks. These are the actual routines we follow for portfolios generating millions in rental revenue.

By the end, you’ll know exactly what to do each day and each week to maximize your revenue potential.

Why Most Hosts Fail at Revenue Management (And How to Fix It)

The short-term rental business operates 24/7. Maintenance emergencies happen. Guest issues arise. Someone always needs something.

In that environment, revenue management becomes the thing you do “when you have time.” Which means it never gets done properly.

The fix is simple but non-negotiable: calendar blocking.

Open your calendar right now. Block out 15-60 minutes every single day for revenue management. Label it clearly. Treat it like any other critical business appointment.

For a portfolio of 20-50 listings, start with 15-30 minutes daily. Larger portfolios need 30-60 minutes. This isn’t optional time. This is protected time where you focus exclusively on revenue optimization.

Without this calendar commitment, you won’t maintain the routine. The daily habit won’t stick. And consistency is everything in revenue management.

Your Daily Revenue Management Routine: The Non-Negotiables

Step 1: Open Your Complete Revenue Dashboard

Before you start analyzing anything, you need your full toolkit accessible:

- Your pricing tool (PriceLabs, Wheelhouse, Beyond, etc.)

- Your Airbnb account

- Your Booking.com account

- All other OTA platforms you use

- Your property management system

Having everything open simultaneously matters because you’ll need to cross-reference information quickly. You might spot something in your bookings that requires checking your PMS settings. You might need to verify listing details on Airbnb.

Set up your workspace so you can move between these platforms efficiently.

Step 2: Review Every Single Booking From Yesterday

This is the foundation of professional revenue management.

Look at every reservation that came in since you last checked. Not just a quick glance at the total number. Actually examine each booking individually.

Why does this matter so much?

Because every booking contains information. A booking represents a real person who chose your property over every other option in your market. That decision tells you something about your competitive position.

Not all bookings contain equal information. Four two-night weekend bookings don’t tell you much. You expect weekend bookings. But here’s what should catch your attention:

- Bookings far in advance (outside your normal booking window)

- Single-night bookings when you prefer longer stays

- Bookings during periods you thought would be slow

- Multiple bookings for the same unit in one day

Early bookings especially deserve investigation. If someone books your property a year in advance when almost no other properties show reservations for those dates, something is happening.

Last week, one portfolio we manage got several bookings for early September, which was unusual timing. A quick investigation revealed a major concert had just been announced. Without catching that booking pattern, those units would have been severely underpriced for a high-demand event.

You can’t track every concert announcement, festival addition, or sporting event in your market. But your bookings will alert you when something is happening.

Step 3: Check for Booking Clusters on Single Properties

Ten bookings across ten properties is normal. Ten bookings for one property in a single day is a red flag.

This pattern almost always means one of two things:

- You’re significantly underpriced

- You made a pricing error (like setting the base price to $20 instead of $200)

When you see clustering, immediately review that property’s pricing settings across all your systems. Check your pricing tool, your PMS, and the OTA platforms directly. Make sure there isn’t a configuration error causing artificially low prices.

Step 4: Analyze Your Last-Minute Inventory (Next 7 Days)

Look at your calendar for the coming week. Focus specifically on:

The upcoming weekend. In most markets, weekends book more reliably than weekdays. If it’s Monday and your weekend inventory shows gaps, you need to make adjustments.

Start small. Add a 5% price reduction override. If you still don’t see bookings by Tuesday, try 10%. Each small price adjustment sends a signal to the OTA algorithms that your property just became more competitive, which can improve your visibility in search results.

Your weekday inventory. Especially during shoulder season, weekdays can be challenging to book. Check if your prices are already at your minimums. Decide whether you want to push them even lower or accept the vacancy.

The key is making these micro-adjustments daily and observing the results. Over time, you’ll develop an intuitive sense of what price points generate bookings in your specific market conditions.

Your pricing tool already applies last-minute discounts automatically. But the tool doesn’t know that this particular weekend might be softer than usual, or that local events are driving unusual demand patterns. That’s why the human review matters.

What You’re Really Learning Through Daily Review

This daily practice isn’t just about catching problems. It’s about building expertise.

When you review bookings every single day for months, you start recognizing patterns. You understand your guests better. You know which property features drive bookings at which price points. You develop a feel for your market’s rhythm.

There’s no substitute for this accumulated experience. No algorithm can fully replace the pattern recognition you develop through consistent daily observation.

Your Weekly Revenue Management Deep Dive

Daily reviews keep you responsive. Weekly reviews keep you strategic.

Block out at least two hours weekly for this deeper analysis. Larger portfolios need three to four hours.

Understanding Market Penetration Index (MPI): Your Most Important Metric

Market Penetration Index is simply your occupancy divided by market occupancy for comparable properties.

If your occupancy over the next 60 days is 30% and the market average is 15%, your MPI is 200%. You’re pacing twice as fast as your competition.

In low season, a high MPI might be acceptable or even desirable. You’re capturing available demand while competitors wait.

In high season, an MPI of 200% almost guarantees you’re underpriced. You’re giving away revenue.

Review MPI for every single unit weekly. This is where you’ll find your opportunities and your problems.

Choosing the Right MPI Window

Your booking window determines which MPI timeframe matters most.

If guests typically book 30 days out in your market, review your 30-day MPI. If bookings happen 60-90 days in advance, use that window.

When in doubt, look at the longer timeframe. A 30-day MPI might miss crucial data if your actual booking window is 60 days. But looking at 90-day MPI when your window is 30 days just shows mostly empty calendar space that doesn’t matter yet.

One exception: if you have owner blocks or other unavailable dates far out, they’ll distort longer MPI calculations. Stick to timeframes before those blocks appear.

Diagnosing Why Units Pace Behind Target

When a property shows 50% MPI and your target is 100%, don’t immediately slash prices.

Low MPI doesn’t always mean pricing problems. Common non-price issues include:

- Recent negative reviews (especially one-star reviews on Airbnb)

- New listings without booking history or reviews

- Distribution problems (listing not appearing in searches)

- Listing description issues

- Photo quality problems

- Misleading or outdated information in the listing

One property we manage wasn’t booking despite competitive pricing and no obvious issues. A careful review of the listing description revealed outdated text warning guests about construction noise. The construction had finished months earlier, but nobody had updated the description. Once removed, bookings normalized.

Always investigate why before adjusting prices based on pacing.

Making Strategic Price Adjustments Based on Pacing

When you determine a property genuinely needs repricing, adjust thoughtfully.

Make small changes. Adjust prices by 5-10%, not 20-30%. Then wait a week to observe the effect.

Small adjustments reduce the risk of overshooting. Recently, changing one property’s minimum from $129 to $124 triggered one booking, which triggered algorithm improvements, which triggered three more bookings. The MPI jumped from 50% to 120% in days.

If you had dropped prices 30%, you would have unnecessarily given away revenue on all those bookings.

Choose the right price lever. Don’t change base prices unless you believe the property is mispriced year-round. If the issue is specific to the next 30-60 days, adjust prices only for that period using overrides or custom pricing.

This distinction matters enormously. Base price changes affect your entire calendar. Targeted adjustments preserve your pricing strategy for future high-demand periods.

Portfolio-Level Pacing Analysis

Individual property MPI tells part of the story. Portfolio-level MPI reveals your strategic position.

At Freewyld Foundry, we track portfolio MPI across the next 12 months using imported PriceLabs data in custom Excel sheets. This shows exactly where we’re pacing ahead or behind by season.

You might discover you’re pacing well for January but badly for February. Or strong for spring but weak for summer bookings that are already happening.

Portfolio-level MPI of 20% for next summer when your target is 100% signals probable overpricing. But you need property-level data to know which units need adjustment.

Sometimes portfolio-level pacing looks perfect because a few properties have long-term bookings that compensate for many empty properties. The average hides the problem. Always examine both portfolio and property metrics.

Peak Demand Date Management: Your High-Stakes Opportunity

College football games. Graduation weekends. Major concerts. Holidays.

These peak demand dates can generate 3-4 times your normal revenue per night. They require special attention every week.

Check two things for all peak dates:

First, verify your MPI for these specific dates. Are you capturing bookings at rates that reflect the demand spike?

Second, confirm your minimum prices are dramatically elevated. This is crucial because peak dates follow different pricing dynamics.

If someone cancels the day before a major event and your last-minute pricing drops to your standard minimum, you’ll rent at normal rates during extraordinary demand. Your minimum prices for peak dates should be 150-300% higher than regular minimums (or more, depending on your market).

This protects you from algorithm-driven price drops during periods when guests will pay premium rates even at the last minute, especially if the market is nearly sold out.

Real-World Example: How Daily and Weekly Routines Caught a Revenue Leak

One portfolio we manage covers multiple properties in a college town. During the weekly MPI review, we noticed one property consistently pacing 40% behind target for all fall weekends.

Daily booking reviews hadn’t shown any red flags because the property was getting bookings, just fewer than comparable units.

Investigation revealed the property allowed one-night bookings for football weekends when demand typically supported 2-3 night minimums. The setting existed in the PMS, bypassing the pricing tool’s minimum night requirements.

One-night bookings were filling the calendar but capturing perhaps 60% of potential revenue. Weekend guests would have happily booked multiple nights at higher total prices.

The fix took five minutes once identified. But without systematic weekly MPI review by property, this issue would have continued indefinitely, costing thousands per season.

This is why the routine matters more than the individual tactics.

Summary & Key Takeaways

Revenue management isn’t about one-time optimization. It’s about consistent routines that compound over time.

Daily essentials:

- Review every single booking for insights about market conditions, pricing effectiveness, and potential setting errors

- Check for booking clusters on individual properties that signal mispricing

- Analyze last-minute inventory (next 7 days) and make small strategic adjustments

- Spend 15-60 minutes daily depending on portfolio size

Weekly deep work:

- Review Market Penetration Index for every property in your portfolio

- Investigate properties pacing behind target to identify root causes beyond pricing

- Make strategic 5-10% price adjustments based on pacing analysis

- Examine portfolio-level pacing across seasons

- Verify peak demand date pricing and minimum price protections

- Allocate at least 2-4 hours weekly depending on portfolio size

The hosts who consistently outperform their markets aren’t necessarily smarter. They’re more systematic. They show up every day. They review the data every week. They make small improvements continuously.

Start building these habits today, and six months from now you’ll have expertise no pricing tool can replicate.

Next Steps: Take Action Now

Block time in your calendar right now for daily and weekly revenue management. Not tomorrow. Not next week. Today.

Open your calendar app and create recurring appointments:

- Daily: 15-60 minutes for booking review and last-minute adjustments

- Weekly: 2-4 hours for MPI analysis and strategic pricing

These time blocks will transform your revenue performance if you protect them consistently.

Questions to consider: What’s currently preventing you from implementing a systematic revenue management routine? Are you tracking MPI for your properties, or just looking at overall occupancy? What would happen to your revenue if you caught just one mispricing issue per month through these routines?

Internal Links:

- Ep679 – 2026 Pricing Strategies Every Short-Term Rental Operator Must Use

https://freewyldfoundry.com/ep679-str-pricing-strategies-2026/ - Ep673 – FIFA World Cup 2026: How STR Hosts Can Win (Action Plan)

https://freewyldfoundry.com/ep673-fifa-world-cup-2026/ - Ep652 – How to Maximize 5-Star Guest Reviews on Airbnb

https://freewyldfoundry.com/ep652-how-to-maximize-5-star-guest-reviews-on-airbnb/