If you think managing pricing for short-term rentals is just like running a hotel with fewer rooms, you’re in for a surprise.

After managing 10,000 hotel rooms across the Caribbean, Adrian Sonneveld made the leap to short-term rental revenue management. His first reaction? “Hold on, this is not calculating 50 rooms. This is like 50 individual hotels.”

In this deep dive, we’ll explore the fundamental differences between hotel revenue management and short-term rental revenue management. Whether you’re a property manager looking to optimize your pricing strategy or simply curious about the complexities of vacation rental pricing, you’ll walk away with actionable insights that can transform how you think about revenue management.

You’ll learn why short-term rentals require more aggressive last-minute discounting, how booking windows work differently, and why every single property demands individual attention in ways hotels never do.

What Is Revenue Management?

Revenue management is the practice of using data and pricing strategies to sell the right product to the right customer at the right price and time. While the core principle applies to both hotels and short-term rentals, the execution differs dramatically between the two industries.

Hotel revenue management optimizes pricing across standardized room inventory with predictable demand patterns, sophisticated data tools, and diversified distribution channels. Revenue managers can rely on historical patterns across hundreds of identical rooms.

Short-term rental revenue management requires treating each unique property as its own micro-business, with individual pricing strategies, limited market data, and heavy dependence on platform algorithms. The all-or-nothing nature of single-property occupancy creates fundamentally different risk calculations.

| Factor | Hotels | Short-Term Rentals |

|---|---|---|

| Inventory | Standardized rooms (4-10 categories) | Every property is unique |

| Occupancy risk | Partial occupancy acceptable | 0% or 100%—no middle ground |

| Booking window | Can fill last-minute | Must capture early bookings |

| Last-minute discounts | 10-20% typical | 30-40% common |

| Brand loyalty | 50%+ repeat guests possible | Under 30% industry-wide |

| Data availability | Sophisticated BI tools | Limited market intelligence |

| Distribution | Multi-channel (OTAs, direct, corporate) | Often 80-85% Airbnb dependent |

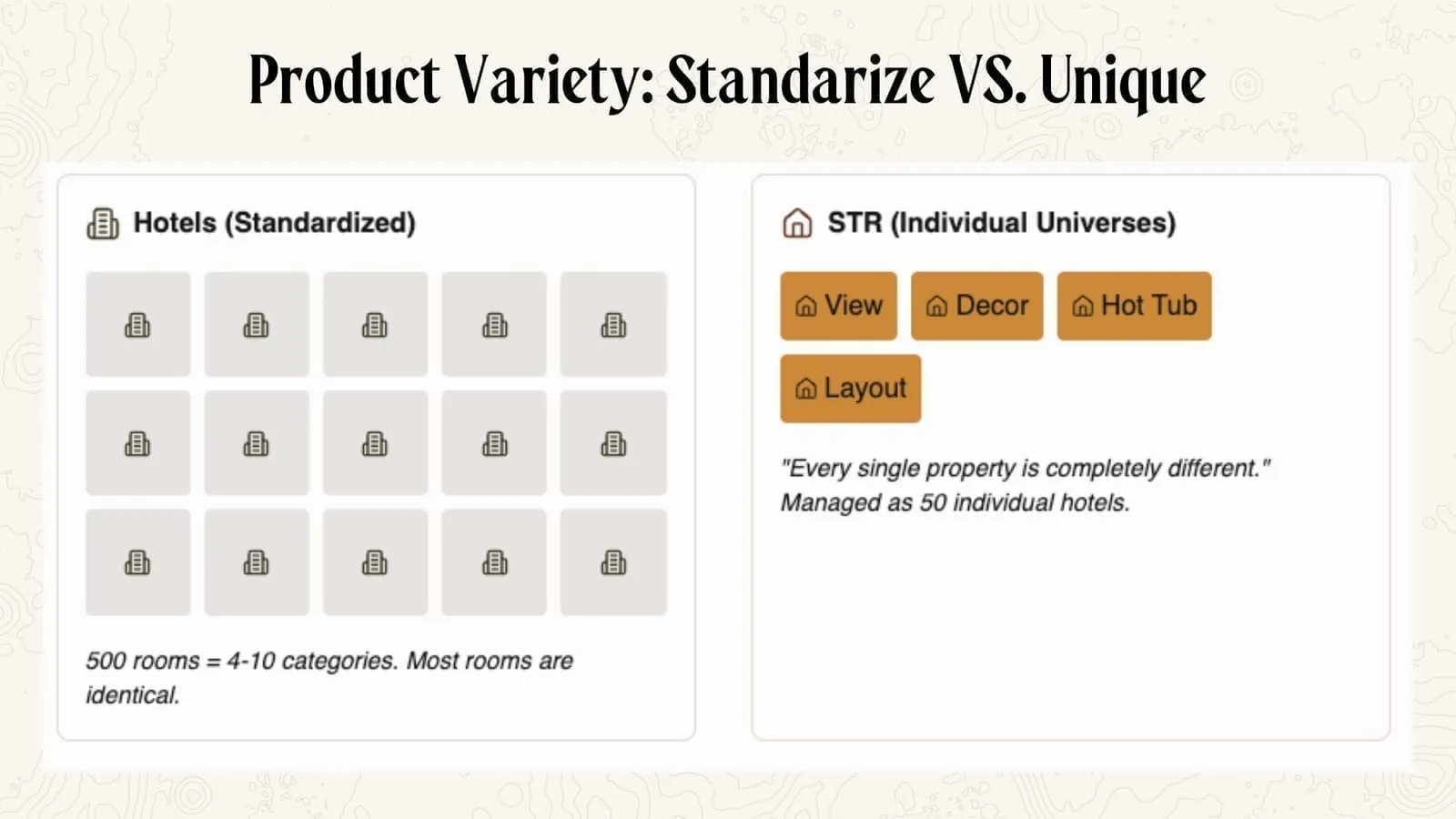

The Product Problem: Why Every Short-Term Rental Is Its Own Universe

Here’s the most shocking difference between hotels and short-term rentals: the product itself.

In a hotel with 500 rooms, you might have four to ten room categories. You’ve got your basic double, your king room, your superior with a balcony, and your suites. Sure, there are differences, but fundamentally, 200 of those rooms are identical. Same bedding, same layout, same amenities.

Short-term rentals? Every single property is completely different.

Even when a property manager has 20 units in the same building, decoration matters. Location within the building matters. The view matters. One unit might have a hot tub, another doesn’t. One has modern furnishings, another is more traditional. These aren’t minor details. They’re fundamental differences that directly impact demand and pricing power.

This creates a unique challenge: you’re essentially managing each property like its own individual hotel. You can’t simply set a base rate and apply it across your portfolio with minor adjustments. Each property requires its own analysis, its own competitive set, and its own pricing strategy.

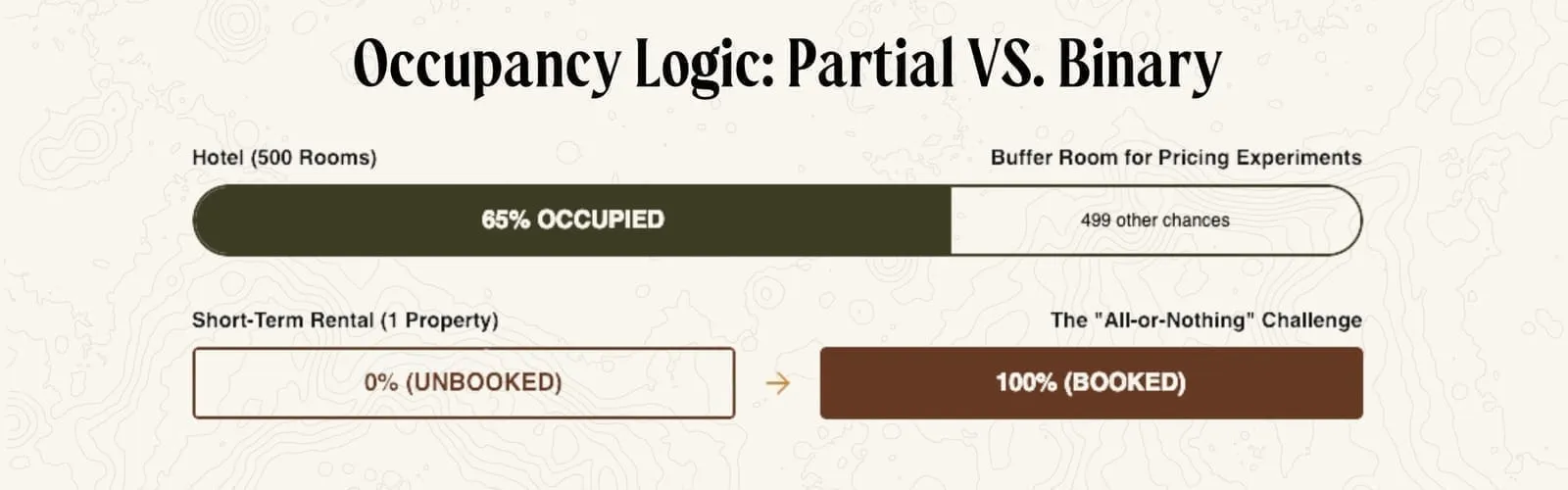

The All-or-Nothing Occupancy Challenge

Here’s another mind-bending reality of short-term rental revenue management: a property is either 0% occupied or 100% occupied. There’s no middle ground.

In a 500-room hotel, selling one room still leaves you with 499 opportunities to generate revenue that night. Your occupancy might be 55% or 65%, giving you buffer room to experiment with pricing.

But in short-term rentals, if you don’t book that property, you’ve lost 100% of potential revenue for that night. Forever. There’s no recovering it.

This fundamental difference changes everything about how you approach pricing strategy, especially as you get closer to arrival dates.

Why Booking Windows Matter More in Short-Term Rentals

In hotel revenue management, booking windows exist, but they’re less critical to survival. City hotels, especially, can fill rooms in the final week before arrival. Business travelers often book last minute. Walk-ins happen. The demand patterns are more predictable and consistent.

Short-term rentals operate in a completely different reality.

If you’re trying to fill a vacation rental the week before Thanksgiving or Christmas, you have a serious problem. Leisure travelers planning family holidays book 30, 60, even 90 days in advance. They’re coordinating multiple people’s schedules, planning activities, and making significant commitments.

The question for short-term rental revenue managers isn’t “will we book?” It’s “when will we book?”

Are you capturing bookings early in the booking window when guests are willing to pay premium rates? Are you positioned competitively in the middle of the booking window? Or are you scrambling last minute with deep discounts?

Understanding Lead Time Strategy

Your lead time strategy becomes absolutely critical. You need to constantly monitor where bookings are coming from in relation to check-in dates. If you’re consistently booking too close to arrival, you’re leaving money on the table. If you’re priced too aggressively early, you might book quickly but miss out on potential revenue.

This requires tracking booking pace for each property individually. What worked for one property might not work for another, even if they’re similar size and in the same market. One might book consistently 45 days out, while another tends to book within 21 days.

Hotels can rely on historical patterns across hundreds of rooms to smooth out these variations. Short-term rentals don’t have that luxury.

The Data Disadvantage: Why STR Revenue Management Is Flying Blind

Hotel chains have sophisticated business intelligence tools. Many large hotel companies even develop their own property management systems that feed directly into revenue management platforms.

Adrian worked with MicroStrategy at Riu Hotels, tracking competitor pricing for every single day of the week and every room category. He could see exactly what the Marriott, Hilton, and other competitors were charging in real-time through tools like STR reports.

Short-term rental managers? They’re working with significantly less data.

Airbnb pricing is visible, sure, but understanding true competitive positioning is much harder. You don’t know what discounts competitors are offering. You can’t see their booking pace. You don’t have standardized competitive set reporting.

Moreover, the tools available in the short-term rental space are still maturing. While hotel revenue management systems have decades of development behind them, short-term rental pricing software is still evolving rapidly.

This data disadvantage means short-term rental revenue managers need to rely more heavily on direct observation, market intelligence from operations teams, and their own analysis of patterns and trends.

Distribution Channels: The Airbnb Dominance Problem

In hotel revenue management, distribution strategy is complex and multifaceted. A major hotel might see:

- 25% direct website bookings

- Multiple OTAs (Expedia, Booking.com, and many others)

- Corporate travel programs

- Group bookings for events

- Tour operators with charter flights

Each channel requires its own pricing strategy. You might offer different rates to corporate clients versus leisure travelers. Group rates follow different logic than individual bookings.

Short-term rentals face a completely different distribution reality: Airbnb dominance.

Many short-term rental managers see 80-85% of bookings coming through Airbnb (industry average for STR operators without strong direct booking channels). Maybe some additional bookings from VRBO and Booking.com. If you have a strong brand, you might drive some direct website bookings.

But you’re essentially optimizing for one primary channel. When you set your pricing strategy, you’re primarily thinking about how that property will appear in Airbnb search results.

This creates both simplification and constraint. You don’t need to manage complex channel strategies, but you also don’t have the flexibility to segment your market across different channels. You’re at the mercy of Airbnb’s algorithm, Airbnb’s policies, and Airbnb’s market position.

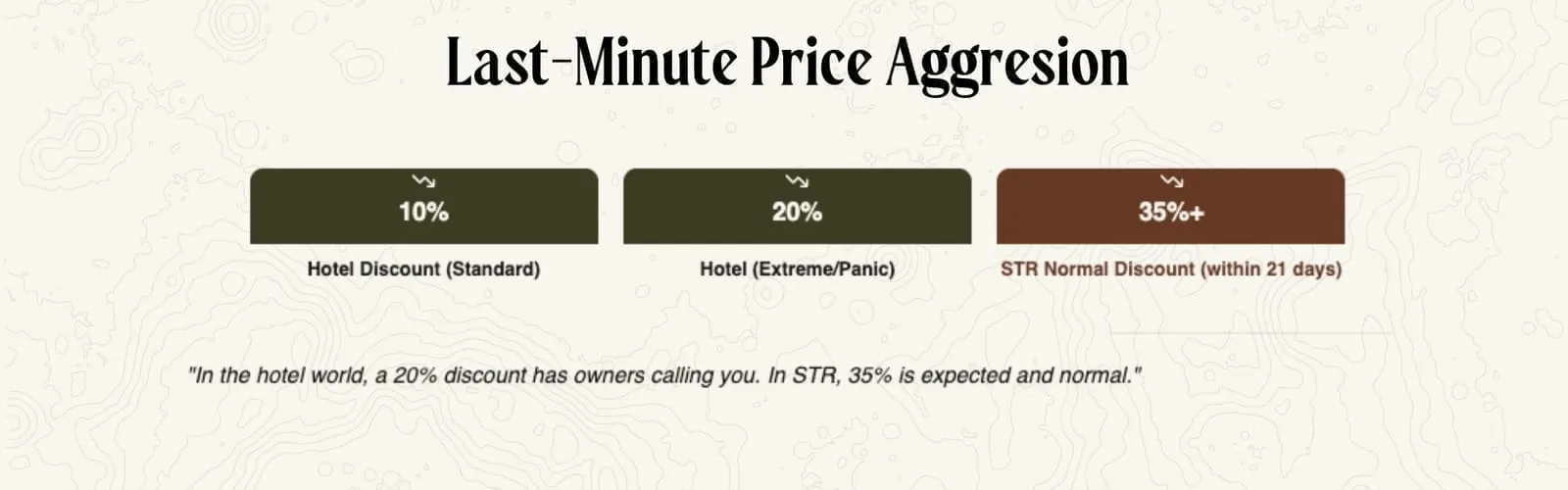

Last-Minute Pricing: Why Discounts Get So Aggressive

In the hotel world, a 10% last-minute discount might be considered significant. Going to 20% off would have ownership calling to question your strategy.

In short-term rentals, 35% discounts within 21 days of arrival are completely normal. Not unusual. Expected.

Why such a massive difference?

Remember the all-or-nothing occupancy problem. If that property doesn’t book, you’ve lost 100% of revenue. The cost of opportunity is enormous, especially on high-demand dates like weekends, holidays, or summer peak season.

Hotels have room to absorb some empty inventory. If you have 100 rooms and end up at 90% occupancy instead of 100% because you held pricing firm, you’re probably still fine. The few rooms you didn’t sell don’t dramatically impact overall performance.

But if you’re a host with two properties and you’re depending on that rental income, an empty weekend is devastating. An empty Thanksgiving week is a financial disaster.

This drives extremely aggressive last-minute discounting behavior in the market. Property managers would rather book at a steep discount than sit empty. And when competitors start dropping prices, it creates a domino effect.

Adrian notes that last-minute competition in some markets can be “fierce” with properties dropping prices by 15% or more as arrival dates approach. For properties without professional revenue management, panic pricing is common.

The Momentum Mystery

Here’s something that doesn’t happen in hotels: a property can be performing amazingly with 90% occupancy for three months, then suddenly drop to 50-60% occupancy for no apparent reason.

The listing looks good. The pricing is competitive. Nothing obvious has changed. But somehow, the property lost momentum and bookings dried up.

Sometimes a long-term stay interrupts the pattern of short-term bookings, and the algorithm needs time to adjust. Sometimes it’s just randomness in a market where each booking is a binary outcome.

Getting that momentum back is complicated and unpredictable. Hotels don’t face this problem. Their steady stream of demand smooths out individual booking volatility.

This unpredictability is why short-term rental revenue management requires constant monitoring and adjustment in ways that hotel revenue management doesn’t.

Real-World Example: Thanksgiving Pricing Strategy

Let’s walk through a practical scenario to illustrate these differences.

Imagine it’s September, and you’re pricing for Thanksgiving in November. In both hotel and short-term rental scenarios, this is a high-demand period.

Hotel Approach:

The revenue manager looks at historical occupancy and rates for Thanksgiving. They check the STR report to see what competitors are charging. They set rates about 15-20% above normal rates for the period. As bookings come in, they monitor pace and adjust incrementally. They’re comfortable waiting because they know business travelers and last-minute leisure travelers will book in the final two weeks. If occupancy is tracking at 70% two weeks out instead of the target 85%, they might drop rates by 5-10% to stimulate demand. Even if they end up at 90% instead of 100%, the performance is acceptable.

Short-Term Rental Approach:

The revenue manager sets premium rates 60-90 days out, knowing that families planning holiday travel book early. They monitor booking pace closely. If properties aren’t booking by 45 days out, they start adjusting. By 30 days out, if key properties are still empty, concern rises significantly. At 21 days out, if properties remain unbooked, aggressive discounting begins. By 14 days out, rates might drop 30-40% because the alternative is sitting empty for one of the most important revenue periods of the year.

The emotional and financial stakes are completely different. The hotel can afford some empty rooms. The short-term rental manager cannot afford empty properties on Thanksgiving.

Brand Loyalty: Why Hotels Win and STRs Struggle

Ask someone about their favorite hotel brand, and they’ll likely have an answer. Marriott. Four Seasons. Hilton. Citizen M. These brands have built loyalty programs, consistent experiences, and direct relationships with travelers.

Riu Hotels reported a 52% loyalty rate (as reported by Adrian Sonneveld, former Riu Hotels revenue manager). More than half of their guests were repeat customers. That’s extraordinary, and it fundamentally changes revenue strategy. When you know half your demand comes from loyal customers who book directly, you can be more confident in your pricing and less reactive to market fluctuations.

Now ask someone about their favorite short-term rental brand.

Awkward silence.

Most people book based on the individual property, not the management company. They’re scrolling through Airbnb looking at prices, photos, and locations. They’re comparing individual homes, not brands.

Even property managers who invest heavily in branding and marketing struggle to build the same kind of loyalty hotels enjoy. Freewyld Foundry, which dedicates significant resources to Instagram marketing and influencer partnerships, achieves around 30% direct bookings (Freewyld Foundry internal data, 2024-2025). That’s exceptional in the short-term rental space, but still far below hotel loyalty rates.

This lack of brand loyalty creates more aggressive competition on listing platforms. Price becomes a more important variable. Trust is built one review at a time, not through decades of brand reputation.

Why Uniqueness Prevents Loyalty

Part of the loyalty problem is actually a feature, not a bug. Every short-term rental is different, and that’s part of the appeal. Guests enjoy staying in different unique properties. The variety is exciting.

Hotels, by contrast, succeed through standardization. When you book a Marriott, you know what you’re getting. That predictability builds trust and loyalty. Business travelers especially value knowing exactly what to expect when they arrive exhausted at 11 PM.

But uniqueness makes it harder to build repeat business. Even guests who loved their stay might want to try something different next time.

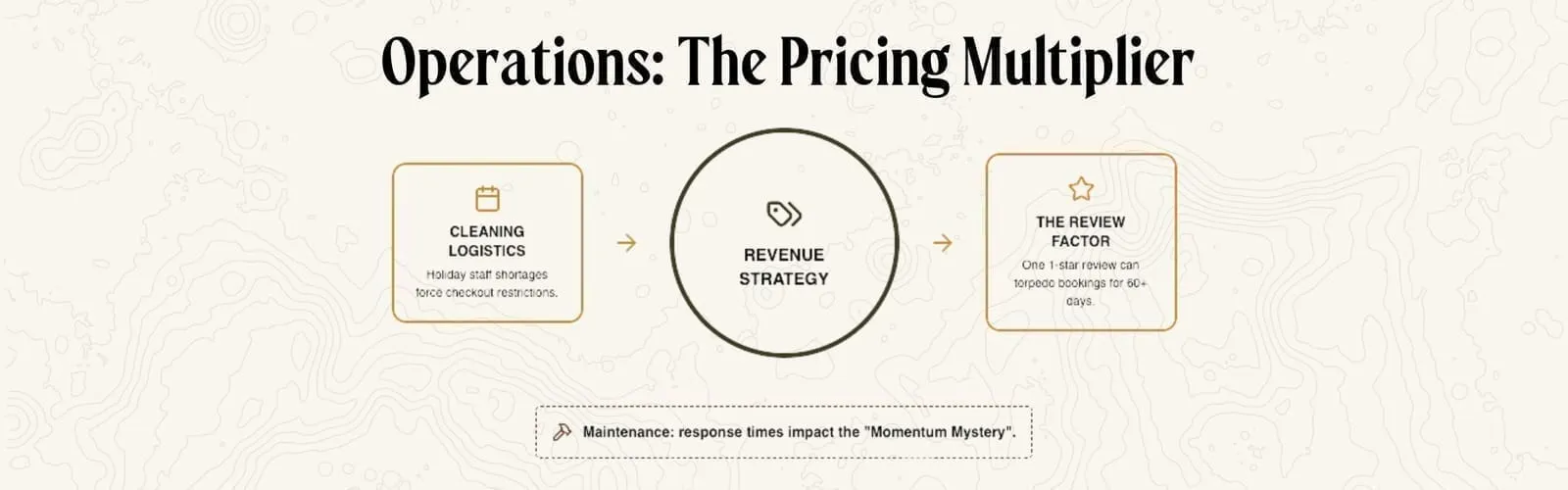

Operations: The Hidden Complexity Multiplier

In hotel revenue management, you can largely ignore operations. You set prices, rooms sell, operations handles everything else. The revenue manager and the hotel manager might have the occasional disagreement, but it’s not a daily integration point.

Short-term rental revenue management requires deep operational understanding.

Why? Because operational constraints directly impact pricing strategy in ways that don’t exist for hotels.

Cleaning Logistics: Around major holidays like Thanksgiving and Christmas, many cleaners take time off. This creates checkout restrictions. You might not be able to allow checkouts on certain days, fundamentally altering your minimum stay strategy and pricing approach.

Minimum Length of Stay: Hotels love one-night stays. The marginal cost is minimal since cleaning teams are already working. Short-term rentals, especially larger homes, often require two or three-night minimums. One-night stays create operational headaches and don’t generate enough revenue to justify the cleaning costs and party risks. This operational constraint directly impacts your revenue potential.

Maintenance Complexity: In a hotel, if something breaks, maintenance is on-site. In short-term rentals with properties spread across a market, maintenance logistics are dramatically more complex. Response times are longer. Guest frustration is higher. And critically, one maintenance issue that leads to a bad review can torpedo your bookings for weeks.

The Review Factor: Hotels can largely ignore individual reviews. Scores on Booking.com or Expedia matter at an aggregate level, but one bad review among thousands barely registers. In short-term rentals, one single one-star review can devastate a property’s performance for 60 days or more. That 4.9 average rating drops to 4.8, and bookings evaporate. Revenue management strategy must account for this operational vulnerability.

Why “Unreasonable Hospitality” Matters More

Because each property is unique and guests don’t have brand loyalty, the operational experience becomes a critical differentiator.

Hotels can get away with standard service. Short-term rentals need to create memorable experiences to stand out. Small touches, thoughtful amenities, exceptional responsiveness, all of these operational elements impact guest satisfaction and reviews.

And those reviews directly impact revenue potential in ways that don’t apply to hotels.

A revenue manager who doesn’t understand these operational dynamics will consistently make suboptimal pricing decisions. You need to know when cleaning constraints require minimum stay adjustments. You need to track which properties have had recent maintenance issues that might impact guest satisfaction. You need to understand which properties offer exceptional experiences that justify premium pricing.

Cancellation Policies: Risk Management in Different Worlds

Hotels typically offer flexible cancellation policies. Cancel up to 24 hours before arrival, no problem. Some even allow same-day cancellations with no penalty.

Why can hotels be so generous? Because they can resell that room easily, especially in the final days before arrival.

Short-term rentals must be more restrictive, even though it impacts algorithmic ranking and conversion rates.

Imagine someone cancels a large home one week before Christmas. What are the chances you resell that property at full rate? Minimal to none. You’ve lost the revenue, and there’s no backup plan.

Hotels also deal with no-shows differently. The volume of no-shows at large hotel chains can be so substantial that pursuing every chargeback becomes operationally impractical. Revenue strategies account for expected no-show percentages.

Hotels can also overbook. If you expect 5% cancellations and no-shows, you can book 105 rooms when you only have 100 available. When everyone actually shows up, you upgrade guests to higher room categories or, in extreme cases, walk them to another hotel.

Short-term rentals can’t overbook. You have one property. If someone cancels last minute, you absorb the loss. This forces more restrictive cancellation policies despite the competitive disadvantage they create.

The Volatility Factor: Why STR Revenue Management Requires Nerves of Steel

If you want a stable, predictable job, stick with hotel revenue management.

Short-term rental revenue management is for people who thrive on volatility and uncertainty. The risk factors are higher. The cost of mistakes is greater. The variables are more numerous and less controllable.

Weekend demand can be 3-4 times weekday demand in leisure markets. Hotels balance this with business travel during the week. Short-term rentals just have to accept the dramatic swings.

Properties can lose momentum unpredictably. Hotels have steady, diversified demand. Special events impact both, but short-term rentals feel the swings more dramatically because each property is all-or-nothing.

Algorithm changes on Airbnb can overnight impact your visibility and bookings. Hotels have diversified distribution reducing platform dependency.

Adrian describes short-term rental revenue management as being “made for people who like some adrenaline in life.” It requires constant monitoring, rapid decision-making, and the ability to analyze and adjust when things don’t go according to plan.

The Education Gap: Learning STR Revenue Management

Want to become a hotel revenue manager? Enroll in a hospitality management program. Dozens of universities offer specialized coursework. Industry associations provide certification programs. Best practices are well-documented and widely taught.

Want to become a short-term rental revenue manager? Good luck finding formal education.

The industry is too new and too fragmented for standardized training programs. There’s no certification process. No consensus on best practices. No textbooks.

You learn by doing, by experimenting, by analyzing results, and by finding mentors who have figured things out through trial and error.

This creates opportunities for those willing to invest in learning, but it also means the industry has huge variation in revenue management sophistication. Some property managers are employing advanced strategies. Others are still setting prices based on gut feeling.

As the industry matures, education and standardization will improve. But for now, it remains a bit of the Wild West.

Summary & Key Takeaways

Short-term rental revenue management is not simplified hotel revenue management. It’s a fundamentally different discipline requiring unique skills, strategies, and mindsets:

- Every property is its own hotel: Unlike standardized hotel rooms, each short-term rental requires individual analysis and strategy. You can’t apply one pricing approach across your entire portfolio.

- Booking windows are critical: Hotels can fill last minute, but short-term rentals must capture bookings earlier in the cycle. Understanding lead times for your market and property types is essential.

- The all-or-nothing risk changes everything: Hotels absorb empty rooms across large inventory. Each empty short-term rental property represents 100% revenue loss, driving more aggressive pricing adjustments.

- Operations and revenue are inseparable: You cannot succeed as a short-term rental revenue manager without deep operational knowledge. Cleaning logistics, maintenance complexity, and guest experience directly impact pricing strategy.

- Expect volatility and embrace it: Short-term rental performance swings more dramatically than hotels. Properties can lose momentum unpredictably. Markets can shift quickly. Success requires constant monitoring and rapid adaptation.

Next Steps: Master Your Revenue Strategy

Ready to elevate your short-term rental revenue management game? The complexity might seem overwhelming, but understanding these fundamental differences from hotel management is your first step toward optimization.

Consider these actions:

Join property management communities and forums where revenue managers share strategies and insights. The collective knowledge of practitioners often exceeds what any formal education program could provide.

Invest in your analytics capabilities. Track booking windows, pace, competitive positioning, and operational metrics for each property. Data-driven decisions consistently outperform gut-feeling pricing.

Stay connected between revenue and operations teams. Regular communication ensures pricing strategies account for real-world constraints and opportunities.

What’s been your biggest surprise in short-term rental revenue management? Have you experienced the momentum mystery where a property inexplicably stops booking? Share your experiences in the comments.

Frequently Asked Questions

What is the difference between hotel and STR revenue management?

Hotel revenue management optimizes pricing across standardized room inventory with predictable demand and sophisticated data tools. Short-term rental revenue management treats each unique property as its own business, with individual pricing strategies, limited market data, and binary occupancy risk—a property is either 0% or 100% booked each night.

Why do Airbnb prices drop so much last minute?

Unlike hotels that can absorb some empty rooms, short-term rental operators face 100% revenue loss on unbooked nights. This all-or-nothing risk drives aggressive last-minute discounting—35% or more within 21 days of arrival is common. When one operator drops prices, competitors follow, creating market-wide discounting pressure.

What is a typical booking window for vacation rentals?

Booking windows vary by market and property type, but leisure travelers typically book vacation rentals 30-90 days in advance for holidays and peak seasons. Properties that consistently book within 14 days of arrival are likely overpriced or overly restrictive earlier in the booking window, leaving revenue on the table.

Can hotel revenue managers transition to STR?

Yes, but the transition requires significant mindset shifts. Hotel revenue managers must adapt to treating each property individually, working with less data, accepting higher volatility, and integrating deeply with operations. The skills transfer, but the application is fundamentally different.

Internal Links:

- Ep679 – 2026 Pricing Strategies Every Short-Term Rental Operator Must Use

https://freewyldfoundry.com/ep679-str-pricing-strategies-2026/ - Ep673 – FIFA World Cup 2026: How STR Hosts Can Win (Action Plan)

https://freewyldfoundry.com/ep673-fifa-world-cup-2026/ - Ep652 – How to Maximize 5-Star Guest Reviews on Airbnb

https://freewyldfoundry.com/ep652-how-to-maximize-5-star-guest-reviews-on-airbnb/